Featured Trading Strategies

Explore our most popular and effective trading strategies, tested and refined by professionals worldwide.

Count:32487

Name: Bollinger + RSI, Double Strategy (by ChartArt) v1.1

Description: This strategy uses the RSI indicator together with the Bollinger Bands to sell when the price is above the upper Bollinger Band (and to buy when this value is below the lower band). This simple strategy only triggers when both the RSI and the Bollinger Band indicators are at the same time in a overbought or oversold condition. UPDATE In this updated version...

Count:20205

Name: MACD + SMA 200 Strategy (by ChartArt)

Description: Here is a combination of the classic MACD (moving average convergence divergence indicator) with the classic slow moving average SMA with period 200 together as a strategy. This strategy goes long if the MACD histogram and the MACD momentum are both above zero and the fast MACD moving average is above the slow MACD moving average. As additional long filter the...

Count:15281

Name: SuperTrend STRATEGY

Description: STRATEGY version of SuperTrend Indicator: SuperTrend is one of the most common ATR based trailing stop indicators. In this version you can change the ATR calculation method from the settings. Default method is RMA, when the alternative method is SMA . The indicator is easy to use and gives an accurate reading about an ongoing trend. It is constructed with two...

Count:13196

Name: PMax Explorer STRATEGY & SCREENER

Description: Profit Maximizer - PMax Explorer STRATEGY & SCREENER screens the BUY and SELL signals (trend reversals) for 20 user defined different tickers in Tradingview charts. Simply input the name of the ticker in Tradingview that you want to screen. Terminology explanation: Confirmed Reversal: PMax reversal that happened in the last bar and cannot be...

Count:10433

Name: GetTrendStrategy

Description: A simple strategy is to determine the trend. Do not use it for real-time transactions. Use it as a Reaffirmation trade entry.

Count:9363

Name: 3Commas Bot

Description: Bjorgum 3Commas Bot A strategy in a box to get you started today With 3rd party API providers growing in popularity, many are turning to automating their strategies on their favorite assets. With so many options and layers of customization possible, TradingView offers a place no better for young or even experienced coders to build a platform from to meet...

Count:9021

Name: Ichimoku + Daily-Candle_X + HULL-MA_X + MacD

Description: Ichimoku_cloud + Daily-Candle_cross(DT) + HuLL-MovingAverage_cross + MacD any timeframe, all indicators settings adjustable for fine tuning to pair/timeframe Target Point and Stop Loss settings set SL low to reduce repaint

Count:8813

Name: Ultimate Strategy Template

Description: Hello Traders As most of you know, I'm a member of the PineCoders community and I sometimes take freelance pine coding jobs for TradingView users. Off the top of my head, users often want to: - convert an indicator into a strategy, so as to get the backtesting statistics from TradingView - add alerts to their indicator/strategy - develop a generic strategy...

Count:8512

Name: Flawless Victory Strategy - 15min BTC Machine Learning Strategy

Description: Hello everyone, I am a heavy Python programmer bringing machine learning to TradingView. This 15 minute Bitcoin Long strategy was created using a machine learning library and 1 year of historical data in Python. Every parameter is hyper optimized to bring you the most profitable buy and sell signals for Bitcoin on the 15min chart. The historical Bitcoin data was...

Count:7704

Name: Golden Cross, SMA 200 Moving Average Strategy (by ChartArt)

Description: This famous moving average strategy is very easy to follow to decide when to buy (go long) and when to take profit. The strategy goes long when the faster SMA 50 (the simple moving average of the last 50 bars) crosses above the slower SMA 200. Orders are closed when the SMA 50 crosses below the SMA 200. This simple strategy does not have any other stop loss or...

Count:7578

Name: ANN Strategy v2

Description: This is version 2 of my ANN strategy. This version will not repaint, but requires some settings configuration. The reason why the old version repainted, is because it used the daily OHLC/4 which kept changing, causing lower timeframes ro repaint. You can now specify which timeframes to use. The bigger timeframe is set in the settings (e.g. 1 day). You set the...

Count:7376

Name: Buy&Sell Strategy depends on AO+Stoch+RSI+ATR by SerdarYILMAZ

Description: This strategy is just for training, its purpose is just learning code in pine script. Don't make buy or sell decision with this strategy. Turkish/Turkce Bu strateji sadece pine script'te kodlamanın nasıl yapildigini ogrenmek icindir. Bu stratejiye dayanarak, kesinlikle al-sat islemleri yapmayin. How it works? When RSI and Stoch are in oversold area and if...

Count:7057

Name: Hull Suite Strategy

Description: Converted the hull suite into a strategy script for easy backtesting and added ability to specify a time periods to backtest over.

Count:7041

Name: Open Close Cross Strategy R5 revised by JustUncleL

Description: This revision is an open Public release, with just some minor changes. It is a revision of the Strategy "Open Close Cross Strategy R2" originally published by @JayRogers. *** USE AT YOUR OWN RISK *** JayRogers : "There are drawing/painting issues in pinescript when working across resolutions/timeframes that I simply cannot fix here.. I will not be putting any...

Count:6579

Name: Twin Optimized Trend Tracker Strategy TOTT

Description: Anıl Özekşi's new strategy which is a combination of 2 Optimized Trend Tracker lines which are vertical displaced from original version with a COEFFICIENT to cope with sideways' false signals which he explained in "Toy Borsacı İçin OTT Kullanım Kılavuzu 2" original version of OTT: OTT Strategy and Screener: You can find a detailed explanation with subtitles...

Count:6326

Name: Bollinger + RSI, Double Strategy Long-Only (by ChartArt) v1.2

Description: This strategy uses the RSI indicator together with the Bollinger Bands to go long when the price is below the lower Bollinger Band (and to close the long trade when this value is above the upper Bollinger band). This simple strategy only places a long, when both the RSI and the Bollinger Bands indicators are at the same time in a oversold condition. In this new...

Count:6323

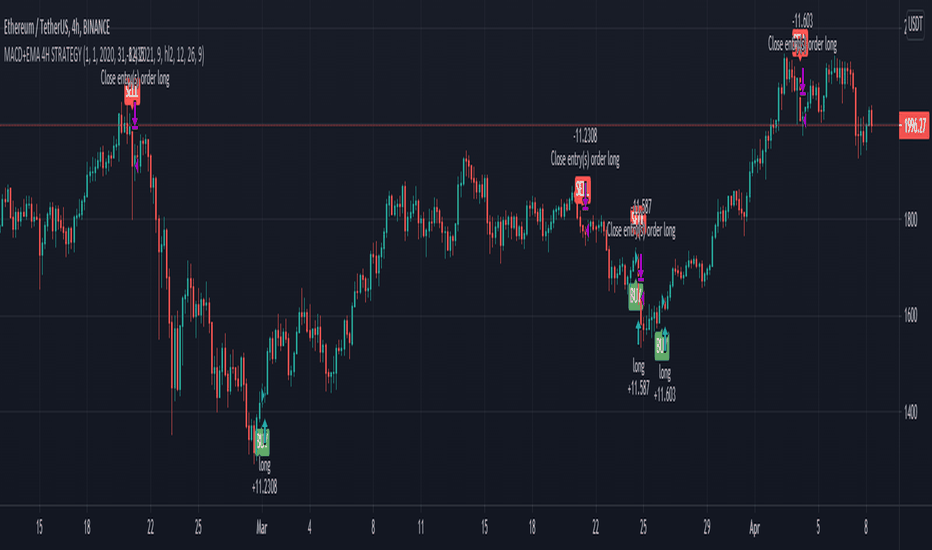

Name: MACD ReLoaded STRATEGY

Description: STRATEGY version of MACD ReLOADED Indicator: A different approach to Gerald Appel's classical Moving Average Convergence Divergence. Appel originaly set MACD with exponential moving averages. In this version users can apply 11 different types of moving averages which they can benefit from their smoothness and vice versa sharpnesses... Built in Moving Average...

Count:6257

Name: Fractal Breakout Strategy (by ChartArt)

Description: This long only strategy determines the price of the last fractal top and enters a trade when the price breaks above the last fractal top. The strategy also calculates the average price of the last fractal tops to get the trend direction. The strategy exits the long trade, when the average of the fractal tops is falling (when the trend is lower highs as measured by...

Count:6075

Name: 20 years old Turtles strategy still work!!

Description: original idea from «Way of the Turtle: The Secret Methods that Turned Ordinary People into Legendary Traders» (2007) CURTIS FAITH

Count:5895

Name: TradingView Alerts to MT4 MT5 + dynamic variables NON-REPAINTING

Description: Accidentally, I’m sharing open-source profitable Forex strategy. Accidentally, because this was aimed to be purely educational material. A few days ago TradingView released a very powerful feature of dynamic values from PineScript now being allowed to be passed in Alerts. And thanks to TradingConnector, they could be instantly executed in MT4 or MT5 platform of...

Count:5756

Name: MACD + Stochastic, Double Strategy (by ChartArt)

Description: This strategy combines the classic stochastic strategy to buy when the stochastic is oversold with a classic MACD strategy to buy when the MACD histogram value goes above the zero line. Only difference to the classic stochastic is a default setting of 71 for overbought (classic setting 80) and 29 for oversold (classic setting 20). Therefore this strategy goes...

Count:5673

Name: Optimized Trend Tracker STRATEGY & SCREENER

Description: Optimized Trend Tracker - OTT STRATEGY & SCREENER screens the BUY and SELL signals (trend reversals) for 20 user defined different tickers in Tradingview charts. Simply input the name of the ticker in Tradingview that you want to screen. Terminology explanation: Confirmed Reversal: OTT reversal that happened in the last bar and cannot be repainted. Potential...

Count:5299

Name: Stochastic + RSI, Double Strategy (by ChartArt)

Description: This strategy combines the classic RSI strategy to sell when the RSI increases over 70 (or to buy when it falls below 30), with the classic Stochastic Slow strategy to sell when the Stochastic oscillator exceeds the value of 80 (and to buy when this value is below 20). This simple strategy only triggers when both the RSI and the Stochastic are together in a...

Count:5133

Name: RSI Divergence Indicator strategy

Description: This strategy is based on RSI divergence indicator. RSI period setting 5 Go Long when Bull or Hidden Bull is shown Exit when RSI goes above 75 OR when bear condition appears

Count:5033

Name: Daily Close Comparison Strategy (by ChartArt via sirolf2009)

Description: Comparing daily close prices as a strategy. This strategy is equal to the very popular "ANN Strategy" coded by sirolf2009(1) which calculates the percentage difference of the daily close price, but this bar-bone version works completely without his Artificial Neural Network (ANN) part. Main difference besides stripping out the ANN is that my version uses...

Count:4856

Name: Bollinger + RSI, Double Strategy (by ChartArt)

Description: Bollinger Bands + RSI, Double Strategy This strategy uses a slower RSI with period 16 to sell when the RSI increases over the value of 55 (or to buy when the value falls below 45), with the classic Bollinger Bands strategy to sell when the price is above the upper Bollinger Band and falls below it (and to buy when the price is below the lower band and rises...

Count:4793

Name: EMA Slope + EMA Cross Strategy (by ChartArt)

Description: This strategy uses divergences between three exponential moving averages and their slope directions as well as crosses between the price and these moving averages to switch between a long or short position. The strategy is non-stop in the market and always either long or short. In addition the moving averages and price bars are colored depending if they are...

Count:4705

Name: How To Set Backtest Date Range

Description: Example how to select and set date range window to be backtested. Normally when you change chart period it changes the number of days being backtested which means as you increas the chart period (for example from 5min to 15min) you also increase the number of days traded, so you can not compare apples to apples for which period would yield best returns for your...

Count:4613

Name: Vix FIX / StochRSI Strategy

Description: This strategy is based off of Chris Moody's Vix Fix Indicator . I simply used his indicator and added some rules around it, specifically on entry and exits. Rules : Enter upon a filtered or aggressive entry If there are multiple entry signals, allow pyramiding Exit when there is Stochastic RSI crossover above 80 This works great on a number of...

Count:4548

Name: AlphaTrend Strategy

Description: The strategy version of AlphaTrend indicator for backtesting and optimisation purposes for TradingView users: Screener / Explorer version and an English explantion video will be published soon... AlphaTrend's parameters are designed for daily and 4H charts, feel free to optimize on all time frames. Hope you all use Alphatrend in your profitable trades. Kıvanç

Count:4538

Name: Open Close Cross Strategy NoRepaint Version by JustUncleL

Description: This is a Non Repaint version of my ever popular "Open Close Cross Strategy R5 revised by JustUncleL". After many comments/PMs on repainting issues of the original script, I decided to create this Non Repaint version for those that require non-repainting signals. Backtesting performance will not be as good as the repaint version, but some script maybe still...

Count:4438

Name: Bjorgum Double Tap

Description: █ OVERVIEW Double Tap is a pattern recognition script aimed at detecting Double Tops and Double Bottoms. Double Tap can be applied to the broker emulator to observe historical results, run as a trading bot for live trade alerts in real time with entry signals, take profit, and stop orders, or to simply detect patterns. █ CONCEPTS How Is A Pattern...

Count:4283

Name: Pivot Point SuperTrend [Backtest]

Description: Hello All, This is backtesting result of following indicator/strategy. I didn't work on adding other indicators. maybe in the future I can try to combine this with other indicators. You can visit following link to see "Pivot Point SuperTrend" . by using this backtesting tool, you can test&find better options There is option "Use Center Line to Close Entry...

Count:4218

Name: BEST Trend Direction Helper (Strategy Edition)

Description: Hello traders A follower asked me to convert my Trend Direction Helper into a strategy So blessed this indicator reached the 1400+ likes milestone - I can't believe how many people are trading with it I based the setup as follow: - Entries on those green/red labels - exit whenever a Simple Moving Averages cross in the opposite direction happen -...

Count:4085

Name: Backtesting 3commas DCA Bot v2

Description: Updating previously published simulated 3commas DCA logic with a sexier insert and more meaningful default parameters.

Count:4022

Name: Trailing SL Strategy [QuantNomad]

Description: I'm a big fan of simple strategies. This one is a very simple one. So it consists only from one Trailing SL. When SL is hit, the position is reversed and SL is tracked for a new position. You can choose one of 3 types of SL: % of your price ATR - it is calculated as current ATR * multiplier Absolute As you can see even this simple strategy can show...

Count:3990

Name: [STRATEGY][RS]ZigZag PA Strategy V4.1

Description: EXPERIMENTAL: WARNING: this strategy repaints after reloading and results are heavily curve fitted, use at your own discretion. UPDATE: (AleksanderThor) add option for a 2nd target, to use you need to activate pyramiding with a setting of 1 manually (not possible to change programatically) .

Count:3820

Name: UT Bot Strategy

Description: UT Bot indicator was inially developer by @Yo_adriiiiaan Idea of original code belongs @HPotter I just took code of Yo_adriiiiaan, cleaned it, deleted all useless pieces of code, transformet to v4 and created a strategy from it. Also I added an input that allows you to swich to signals from Heiking Ashi. I saw that author uses HA for the indicator and on HA it...

Count:3703

Name: [STRATEGY][RS]MicuRobert EMA cross V2

Description: Great thanks Ricardo , watch this man . Start at 2014 December with 1000 euro.

Count:3669

Name: Moon Phases Strategy [LuxAlgo]

Description: Trading moon phases has become quite popular among traders, believing that there exists a relationship between moon phases and market movements. This strategy is based on an estimate of moon phases with the possibility to use different methods to determine long/short positions based on moon phases. Note that we assume moon phases are perfectly periodic with a...

Count:3575

Name: RSI versus SMA (no repaint)

Description: *** USE AT YOUR OWN RISK *** Nothing is perfect, and all decisions by you are on your own head. And stuff. Description: It's RSI versus a Simple Moving Average.. Not sure it really needs much more description. Should not repaint - Automatically offsets by 1 bar if anything other than "open" selected as RSI source. ...sometimes smashing things...

Count:3555

Name: Super Trend Daily 2.0 BF 🚀

Description: This is my Super Trend Daily strategy but with one important difference. You can now adjust settings for long or short signals individually and separately. For example, the condition for a long signal may require a different parameter setting than the condition for a short signal. Each parameter in the signal generation can be tuned. You can also decide what kind...

Count:3526

Name: Strategy Code Example - Risk Management

Description: *** THIS IS JUST AN EXAMPLE OF STRATEGY RISK MANAGEMENT CODE IMPLEMENTATION *** For my own future reference, and for anyone else who needs it. Pine script strategy code can be confusing and awkward, so I finally sat down and had a little think about it and put something together that actually works (i think...) Code is commented where I felt might be necessary...

Count:3510

Name: RSI-VWAP INDICATOR

Description: This simple indicator provides great results. It is the popular RSI indicator with VWAP as a source instead of close. What is the Volume Weighted Average Price (VWAP)? VWAP is calculated by adding up the dollars traded for every transaction (price multiplied by the number of shares traded) and then dividing by the total shares traded. That is, volume. On the...

Count:3506

Name: VWAP + Fibo Dev Extensions Strategy

Description: Based on my VWAP + Fibo deviations indicator, I tested some strategies to see if the indicator can be profitable; and I got it ! This strategy uses: H1 timeframe Weekly VWAP +1.618 / +2.618 / -1.618 / -2.618 Deviations Extensions to create 2 bands The value of the deviation First, the 2 bands are plotted : +1.618/+2.618 painted in red and -1.618/-2.618...

Count:3499

Name: Hammers & Stars Strategy

Description: Overview This script trades basic hammer and shooting star candlestick patterns. It's an extremely simple strategy with minimal filters, and according to my personal manual backtesting and automated trading results, performs best on the Daily chart on certain forex pairs. It is intended to be traded on the forex markets but theoretically should work on all...

Count:3395

Name: [STRATEGY][UL]Price Divergence Strategy v1.0

Description: Created by Request: This is a trend trading strategy that uses Price Divergence detection signals that are confirmed by the "Murrey's Math Oscillator" (Donchanin Channel based). Strategy Code Based on: Price Divergence Detector V2 by RicardoSantos UCS_Murrey's Math Oscillator by Ucsgears Strategy Risk Management Based on: Strategy Code Example by...

Count:3377

Name: Moving Average Cross and/or Bbands bot

Description: Hello TradingView and world! This is one of our latest concepts for an actual bot builder. This script comes with a bunch of features that we're hoping will alleviate a lot of the stress and confusion around using and building strategies here on TV. Especially if the end-goal is to automate the strategies using Autoview. This is a combination of 2 strategies,...

Count:3356

Name: 72s Strat: Backtesting Adaptive HMA+ pt.1

Description: This is a follow up to my previous publication of Adaptive HMA+ few months ago, as a mean to provide some kind of initial backtesting tools. Which can be use to explore many possible strategies, optimise its settings to better conform user's pair/tf, and hopefully able to help tweaking your general strategy. If you haven't read the study or use the indicator,...

Count:3305

Name: Bollinger Band with RSI

Description: Using combination bollinger band and RSI indicator as guide to predict price volatility and the best entry point. The strategy logic is pretty straightforward where we're interested with close price that touches the lower bollinger band ; there are only two scenarios that will happened after the price reaches the lower band; the price might rebound from the lower...

Count:3287

Name: Backtest Adapter

Description: This is a proof-of-concept Backtest Adapter that can be used with my recent publication "Machine Learning: Lorentzian Classification" located here: This adapter is helpful because it enables interactive backtesting with TradingView's built-in "Strategy Tester" framework without the need to translate the logic from an "indicator" script to a "strategy"...

Count:3123

Name: Full CRYPTO pack macd, rsi, obv, ema strategy

Description: This is a simple, yet very efficient crypto strategy, adapted to 4h time frame, on big coins like ETH and BTC. However it can be adapted to other markets, timeframes etc For this strategy I use a combination of a trend line, an oscillator, price action and volume. This strategy has both the opportunity to go long and short. As well, it has a leverage simulator...

Count:3119

Name: BEST Engulfing + Breakout Strategy

Description: Hello traders This is a simple algorithm for a Tradingview strategy tracking a convergence of 2 unrelated indicators. Convergence is the solution to my trading problems. It's a puzzle with infinite possibilities and only a few working combinations. Here's one that I like - Engulfing pattern - Price vs Moving average for detecting a breakout Definition...

Count:3015

Name: Full strategy AllinOne with risk management MACD RSI PSAR ATR MA

Description: Hey, I am glad to present you one of the strategies where I put a lot of time in it. This strategy can be adapted to all type of timecharts like scalping, daytrading or swing. The context is the next one : First we have the ATR to calculate our TP/SL points. At the same time we have another rule once we enter(we enter based on % risk from total equity, in this...

Count:3008

Name: Grab Trading System

Description: Hello All, This is "Grab Trading System" script defined in the book "Trend Following" by Michael W. Covel. also named as "Two-box system". I made small changes and I guess that it can be improved more. The definition: Far box defines major trend; system trades only in same direction as major trend, meanwhile fading the signals of near box. Last trade in each...

Count:2974

Name: SUPERTREND ATR WITH TRAILING STOP LOSS

Description: ## THIS SCRIPT IS ON GITHUB ## MORE BACKTEST SuperTrend is a moving stop and reversal line based on the volatility (ATR). The strategy will ride up your stop loss when price moviment 1%. The strategy will close your operation when the market price crossed the stop loss. The strategy will close operation when the line based on the volatility will...

Count:2962

Name: How to automate this strategy for free using a chrome extension.

Description: Hey everyone, Recently we developed a chrome extension for automating TradingView strategies using the alerts they provide. Initially we were charging a monthly fee for the extension, but we have now decided to make it FREE for everyone. So to display the power of automating strategies via TradingView, we figured we would also provide a profitable strategy along...

Count:2940

Name: Easy System 420

Description: In this strategy, 15 indicators are used, each giving its results as a numerical value, which then is added or subtracted from the total points, gathered from all 15 indicators. Many thanks to RafaelZioni for his great work making the EasySys1 script which i modified to create this script. Onchart is drawn some of the indicators, but not all, a info panel is...

Count:2909

Name: UT Bot Strategy with Backtesting Range [QuantNomad]

Description: UT Bot indicator was inially developer by @Yo_adriiiiaan Idea of original code belongs @HPotter I can't update my original UT Bot Strategy so I publishing new strategy with backtesting range included. I just took code of Yo_adriiiiaan, cleaned it, deleted all useless pieces of code, transformet to v4 and created a strategy from it. Also I added an input that...

Count:2901

Name: [STRATEGY][RS]Spot/Binary Scalper V0

Description: Request for: khizon01 Adapted from: www.binaryoptionsedge.com

Count:2825

Name: Strategy based on Squeeze Momentum Indicator [LazyBear]

Description: This Strategy is based on LazyBear Squeeze Momentum Indicator. I added some custom feature and filters. You can customize a lot of features to get a profitable strategy. Here is a link to original study. Please use comment section for any feedback. Next improvement (only to whom is interested to this script and follows me): study with alerts on multiple...

Count:2760

Name: EVWMA VWAP MACD Strategy [QuantNomad]

Description: Based on comment of @coondawg71 I tried to compare VWAP and EVWMA. Both are sort of moving averages so I decided to create a MACD based on these 2 indicators. In parameters you can set EVWMA Length and 2 smoothing lengths for "macd" and "signal". Strategy seems to work pretty good at 2h-8h timeframes for crypto. What do you thing about it?

Count:2718

Name: Stop loss and Take Profit in $$ example

Description: This is a simple exit example in $$ (symbol's currency) for educational purpose .

Count:2675

Name: Pinescript v4 - The Holy Grail (Trailing Stop)

Description: After studying several other scripts, I believe I have found the Holy Grail! (Or perhaps I've just found a bug with Tradingview's Pinescript v4 language) Anyhow, I'm publishing this script in the hope that someone smarter than myself could shed some light on the fact that adding a trailing stop to any strategy seems to make it miraculously...no that's an...

Count:2669

Name: Hull Moving Average Swing Trader

Description: Hull Moving Average Strategy 2 X HMA's, 1st HMA on current price (recommended source OPEN) 2nd HMA on previous candle. signal on crossover. Buy and Sell signals on chart, red & green view pane (Green Buy, Red Sell)

Count:2659

Name: Support-Resistance breakout

Description: Strategy based on longing resistance breakout and shorting support breakout. It defines highs and lows using fractal with 2 bars for confirming high/lows. So it has 2 bars lag. It calculates the difference between sma with defined length (21 by default) of highs and of lows and uses it as alt SR level. This idea I took from synapticEx's indicator...

Count:2658

Name: Acrypto - Weighted Strategy

Description: Hello traders! I have been developing a fully customizable algo over the last year. The algorithm is based on a set of different strategies, each with its own weight (weighted strategy). The set of strategies that I currently use are 5: MACD Stochastic RSI RSI Supertrend MA crossover Moreover, the algo includes STOP losses criteria and a taking...

Count:2654

Name: Simple profitable trading strategy

Description: This strategy has three components. Philakones EMAs are a sequence of five fibonacci EMAs. They range from 55 candles (green) to 8 candles (red) in length. A strong trend or breakout is marked by the emas appearing in sequence of their length from 8 to 55 or vice versa. These EMAs are also used to signal an exit. Only two EMAs are used for exit signals -...

Count:2640

Name: Ichimoku Kinko Hyo: Basic Strategy

Description: Ichimoku Kinko Hyo: Basic Strategy Entry/Exit orders are placed when three basic signals are triggered. Ichimoku Signals: 1) Tenkan-Sen/Kijun-Sen Cross Bullish: Tenkan-Sen is above the Kijun-Sen. Bearish: Tenkan-Sen is below the Kijun-Sen. 2) Chikou-Span Cross Bullish: Chikou-Span is above the close of 26 bars ago. Bearish: Chikou-Span is below the...

Count:2627

Name: Best Supertrend CCI Strategy

Description: Hello traders Someone requested the strategy version of the Supertrend CCI indicator It's a Supertrend not based on candle close but based on a CCI ( Commodity Channel Index ) How does it work? Bull event: CCI crossing over the 0 line Bear event: CCI crossing below the 0 line When the event is triggered, the script will plot the Supertrend as follow UP...

Count:2615

Name: Solution Zigma - Fibonacci Impulse

Description: 'Solution Zigma' is strategy for any securities because this strategy use EMA of Fibonacci Level and Plot Like candle easy for analysis trend impulse. This strategy used DMI(ADX) for filter sideway but not greatest indicator, Please use this strategy with Risk Management.

Count:2575

Name: Simple RSI-MA Algo Beats DOW By Huge Margin Over Past 100 Years!

Description: This simple RSI-MA long/short algorithm beats the Dow by a FREAKING HUGE margin over the past century (excluding dividends and trading costs). The algorithm uses a fast SMA of the RSI as a buy/cover signal and a slow SMA of the RSI as a sell/short signal. Backtest period = 09/17/1916 - 11/02/2015 Dow = 98 --> 17,830 = +18,094% = 5.38% CAGR Algorithm = net...

Count:2573

Name: Super Scalper - 5 Min 15 Min

Description: This strategy is based on RSI and ATR Bands which works better in 5 and 15 Mins time frame. Perform enough back testing with 1:2R before using in real time. Entry only on trade on screen symbols, use additional buy/sell alerts to book profit or to trail SL. I have also added Golden Cross Over of 65 and 21 EMA to have confirmation on trend.

Count:2476

Name: Range Filter Buy and Sell 5min [Strategy]

Description: - Backtest of Range Filter Buy and Sell 5min - including testing period, TP/SL

Count:2452

Name: BUY and SELL - Backtest single EMA cross By che_trader

Description: Hi, I hope you're well! At the request of my friend @jansrbtc I'm going to publish a simple emas crossing strategy. We will do long or short at the cross of the two ema. Good strategy for when an asset is in trend. Warm: In choppy periods this indicator can be very affected by large drawdowns. Enjoy!

Count:2444

Name: FTSMA - Trend is your frend

Description: This my new solid strategy: if you belive that "TREND IS YOUR FRIEND" this is for you! I have tested with many pairs and at many timeframes and have profit with just minor changes in settings. I suggest to use it for intraday trading . VERY IMPORTANT NOTE: this is a trend following strategy, so the target is to stay in the trade as much as possible. If your...

Count:2407

Name: Monthly Returns in PineScript Strategies

Description: I'm not 100% satisfied with the strategy performance output I receive from TradingView. Quite often I want to see something that is not available by default. I usually export raw trades/metrics from TradingView and then do additional analysis manually. But with tables, you can build additional metrics and tools for your strategies quite easily. This script will...

Count:2396

Name: QuantNomad - Heikin-Ashi PSAR Strategy

Description: Continue experimenting with different combinations of strategies. Here is the PSAR Strategy calculated based on HA candles. HA is already calculated inside the script, do not apply it to HA candles. Strategy is calculated based on 25% equity invested with 0.1% commission. #################### Disclaimer Please remember that past performance may not be...

Count:2396

Name: Scalping Support Resistance Strategy

Description: Scalping strategy for BTC using one line: Support Resistance. The strategy draws a line based on the minimum value of the average of High, Low, and Close for a given bar. The entries are carried out on the breakdown of this line. Exits are managed by the specified in the script's inputs take-profit and stop-loss percentages. From Stream: www.tradingview.com

Count:2384

Name: Fibonacci + RSI - Strategy

Description: Strategy: Fibonacci + RSI: - Intraday trading strategy (Scalping). Time Frames Tested with best Results: 30 Minutes. 5 Minutes. 15 Minutes. 1 Minute Indicators Used: RSI (30 / 70) Fibonacci (1 - 0.784) How it Works: Once the Price Hits the 1 or -1 Fibonacci Level and bounces a little bit, It checks the RSI if Over Bought or Over...

Count:2380

Name: Delta-RSI Strategy (with filters)

Description: Delta-RSI Strategy (with filters): This is a version of the Delta-RSI Oscillator strategy with several criteria available to filter entry and exit signals. This script is also suitable for backtesting over a user-defined period and offers several risk management options (take profit and stop loss). Since the publication of the Delta-RSI Oscillator script, I have...

Count:2370

Name: Crypto BOT lower timeframes

Description: This is a crypto bot designed for lower time frames. Its made of 2 EMA, one fast and one slower . They are combined together with Stochastic, MACD and price action patterns. For entries we have multiple conditions : First we check if one of our last 4 closed candles crossed above or below the faster EMA. After that for long, we check that last close is above...

Count:2353

Name: [STRATEGY][RS]ZigZag PA Strategy V4

Description: EXPERIMENTAL: WARNING: highly curve fitted results, if you dont know whats going on stay away.

Count:2352

Name: [Backtest]QQE Cross v6.0 by JustUncleL

Description: Description: This is the Backtest version of the " QQE Cross v6.0 by JustUncleL" Tool, can be used to optimize settings.

Count:2351

Name: QQE MOD + SSL Hybrid + Waddah Attar Explosion

Description: TRADE CONDITIONS Long entry: QQE Mod changes to Blue (leading indicator) SSL Hybrid is Blue and price is above MA Channel line Waddah Attar Explosion is Green and above Explosion line Short entry: QQE Mod changes to Red (leading indicator) SSL Hybrid is Red and price is below MA Channel line Waddah Attar Explosion is Red and above...

Count:2325

Name: Crypto Scalper Divergence Macd Psar Ema 200

Description: This is a very efficient crypto scalper adapted to very short timeframes, however it can be optimized for other timeframes and assests as well. Its components are MACD P SAR EMA 200 Risk management Rules for entry: For short : we have an uptrend on PSAR , histogram is positive (divergence MACD) and close of a candle is below EMA 200 For long : we dont have an...

Count:2193

Name: Bollinger Bands Breakout Strategy

Description: Bollinger Bands Breakout Strategy is the strategy version of Bollinger Bands Filter study version, which can be found under my scripts page. The strategy goes long when price closes above the upper band and goes short signal when price closes below the lower band. Bollinger Bands is a classic indicator that uses a simple moving average of 20 periods, along...

Count:2187

Name: Forex Master v4.0 (EUR/USD Mean-Reversion Algorithm)

Description: DESCRIPTION Forex Master v4.0 is a mean-reversion algorithm currently optimized for trading the EUR/USD pair on the 5M chart interval. All indicator inputs use the period's closing price and all trades are executed at the open of the period following the period where the trade signal was generated. There are 3 main components that make up Forex Master v4.0: ...

Count:2181

Name: Profit Maximizer Strategy

Description: First I would like to thank to @KivancOzbilgic for developing this indicator. All the credit goes to him. I just created a strategy, in order to try to find the perfect parameters, timeframe and currency for it. I will provide below the same description like he has in the publish of profit maximizer Profit Maximizer - PMax combines the powerful sides of MOST...

Count:2173

Name: HULLTSIBOT

Description: Do you like TSI indicator? Do you like HMA indicator? The all new, HULLTSIBOT indicator! About: TSI indicator was on a space mission to mine other planets and then the crew stumbled upon a bunch of HMA indicator eggs. In the darkness of the slime room they found, There was a suddenly a bunch of failing and swearing and machinegun fire muzzle flashes, then all...

Count:2163

Name: Auto Fibo on Indicators

Description: This drawing tool aims to draw auto Fibonacci Retracement Levels on desired indicators. Users can define the target indicator to draw Auto Fibo Lines, from the "settings tab": There are six commonly used indicators below the charts that can be selected to draw Fibonacci Retracement lines on: RSI : Relative Strength Index CCI : Commodity Channel Index MFI : Money...

Count:2141

Name: Stepped trailing strategy example

Description: This is a stepped trailing exit example for educational purpose . Short brief. There are 1 stop loss and 3 profit levels. When first tp is reached we move stop loss to break-even. When second tp is reached we move stop loss to first tp. When third tp is reached we exit by profit.

Count:2112

Name: [STRATEGY][RS]Open Session Breakout Trader

Description: EXPERIMENTAL: use at your own discretion. custom session breakout strategy, it uses a percentage of daily atr to set breakout limits. strategy only viable for intraday timeframes and is suggested under 1hour.

Count:2099

Name: EMA Slope Trend Follower Strategy

Description: This strategy is based on the slope of the EMA130. Over that slope, the script calculates two EMAs (9,21) which are used to generate the main entry and exit signal. In particular, the strategy enters a LONG position when EMA9 > EMA21. On the contrary, it closes the LONG and opens a SHORT when EMA9 < EMA21. When the slope of the EMA130 is rising, it means that...

Count:2086

Name: Moving Regression Band Breakout strategy

Description: Following the introduction of the Moving Regression Prediction Bands indicator (see link below), I'd like to propose how to utilize it in a simple band breakout strategy : Go long after the candle closes above the upper band . The lower band (alternatively, the lower band minus the 14-period ATR or the central line ) will serve as a support line . ...

Count:2084

Name: ANN 2 signals

Description: This is a different approach from my original ANN strategy. This version does 2 ANN predictions and only when they are both in the same direction, a trade will be opened. When either of them switches, the trade is closed.

Count:2076

Name: [BACKTEST]Traders Dynamic Index Indicator Alert by JustUncleL

Description: By request, this script is a "strategy" version of my "Traders Dynamic Index Indicator Alert" script, made available for backtesting to help find optimal trade settings for a particular asset.

Count:2067

Name: Mirocana Strategy

Description: Check out this strategy. for more information: mirocana.com

Count:2056

Name: DCA Bot Long/Short

Description: Thanks to @TheTradingParrot for the inspiration and knowledge shared. Thanks to @ericlin0122 for the original DCA Bot Emulator which is the backbone of this strategy. The script simulates DCA strategy with parameters used in 3commas DCA bots for futures trading. Experiment with parameters to find your trading setup. Beware how large your total leveraged...

Count:2022

Name: BEST ABCD Pattern Strategy

Description: Hello traders This is the strategy version of this script I - Concept I present to you, ladies and gentlemen, the first screener for harmonic patterns. Starting with an ACBD pattern screener this time!! I used the calculations from Ricardo Santo's script In short, he's using fractals (regular or Bill Williams ) for the pattern calculations. A...

Count:2002

Name: TradePro's Trading Idea Cipher Divergence EMA Pb Strategy

Description: Here I present you on of Trade Pro's Trading Idea: Cipher B+ Divergence EMA Pullback Strategy. Optimized the crypto pairBTC/USDT in the 30 minute chart. There is the possibility to switch between short and long positions. You can choose between 2 different take profit/stop loss types: The Lowest Low/ Highest High Stop Loss/ Take Profit and the ATR Take Profit/...

Count:2000

Name: Trend Surfers - Premium Breakout + Alerts

Description: Trend Surfers - Premium Breakout Strategy with Alerts I am happy today to release the first free Trend Surfers complete Breakout Strategy! The strategy includes: Entry for Long and Short Stoploss Position Size Exit Signal Risk Management Feature How the strategy works This is a Trend Following strategy. The strategy will have drawdowns, but they...

Count:1993

Name: Strategy Designer

Description: Hello traders. Thanks to the tool I have published, everyone who knows or does not know coding will be able to create strategies and see the results instantly on the screen. Yes it looks very nice :) What does this script do? Thanks to this tool, even if you don't know any coding, you will be able to create your own strategies. You can add and remove...

Count:1993

Name: BTC bot

Description: I made good money on this bot in last few month so i decided to donate it to community (its from my private bot collection) design for BTC mainly . it a great bot for longs , shity for shorts :) no security in this bot so no repaint the key issue in any bot design is to find good low , after you just exit by take profit the exit strategy here is based on pivot...

Count:1974

Name: The Always Winning Holy Grail Strategy - Not (by ChartArt)

Description: How to win all the time if 1+1 = 2 The most upvoted strategies on Tradingview are those which seemingly work 100%, but they actually don't at all because they are repainting and would not work in live trading reality. They are using the multi-time-frame strategy testing bug and thereby trade during the backtest on close prices before the bar has closed in...

Count:1921

Name: Fibonacci Ranges (Real-Time) [LuxAlgo]

Description: The "Fibonacci Ranges" indicator combines Fibonacci ratio-derived ranges (channels), together with a Fibonacci pattern of the latest swing high/low. 🔶 USAGE The indicator draws real-time ranges based on Fibonacci ratios as well as retracements. Breakouts from a Fibonacci Channel are also indicated by labels, indicating a potential reversal. Each...

Count:1919

Name: Swing Trading System RSI

Description: This is an RSI Swing Trading System roughly translated from backtestwizard.com . It uses ATR for profit target & stops. It uses a 26 week EMA filter to go long.

Count:1919

Name: BEST Candle Meter/Sequential Strategy

Description: Hello ladies and gentlemen 📒 INDICATOR OF THE DAY 📒 The TD sequential fans are going to love that one. TD Sequential has two parts – TD Setup and TD Countdown. The first phase of TD Sequential starts with a TD Setup and is completed with a 9 count. When the 9 count is completed, it is at that point, a price pause, price pullback, or reversal is likely. The...

Count:1919

Name: Scalping Trading System bot Crypto and Stocks

Description: This is a trend trading strategy scalping bot that can work with any type of market. However I concluded my tests so far with Crypto, Stocks and Forex, and with optimizations always could be found some profitable settings. Indicators SImple Moving Average Exponential Moving Average Keltner Channels MACD Histogram Stochastics Rules for entry long= Close of...

Count:1914

Name: RSI-VWAP Indicator %

Description: █ OVERALL Simple and effective script that, as you already know, uses vwap as source of the rsi, and with good results as long as the market has no long-term downtrend. RsiVwap = rsi (vwap (close), Length) The default settings are for BTC in a 30 minute time frame. For other pairs and time frames you just have to play with the settings. █ FEATURES • The...

Count:1897

Name: Grid Like Strategy

Description: It is possible to use progressive position sizing in order to recover from past losses, a well-known position sizing system being the "martingale", which consists of doubling your position size after a loss, this allows you to recover any previous losses in a losing streak + winning an extra. This system has seen a lot of attention from the trading community...

Count:1893

Name: Noro's Trend Ribbon Strategy

Description: One moving average ( SMA ) is used. The channel is convened at a moving average rather than prices. Blue is a uptrend. Red is a downtrend. If the candle has closed above the ribbon - open long (and close short) If the candle has closed below the ribbon - open short (and close long)

Count:1873

Name: Super Z strategy - Thanks to Rafael Zioni

Description: //Original script //https://www.tradingview.com/script/wYknDlLx-super-Z/ This is a test for verifying if this interesting study works well. The author, thanks to him!!!, advise a possible repaint because the script uses security function. Refer to tradingview.com for more info on repainting: www.tradingview.com QUOTE: We can see repainting in the following...

Count:1844

Name: RSI Trend Crypto

Description: Dear community, Today I want to present you one of my favorite and simple trading bots: The RSI Trend. This bot is based on the RSI, which normally is used as a trend reversal indicator. However, here it’s used as a trend finding indicator, often with great success. This bot making long-only trades, which is quite successful in bull-markets like the one we’re...

Count:1841

Name: FRAMA - Supertrend strategy

Description: FRAMA Strategy I found this strategy on internet, in a well-known forex forum. I have translated the two indicators mentioned in that strategy (originally in mq4) in pine script. Thanks to Fractured and Shizaru for the FRAMA snippets, to mejialucas for Supertrend snippet, to JayRogers for trade management snippet and to Trost for backtesting snippet. I also added...

Count:1838

Name: Strategy Follow Line MTF Any MM Average

Description: The objective is only to evaluate different configurations of the indicator "Follow Line MTF Any MM Average". The strategy does not have position management, it's very basic, this indicator should be used to see trend, range zones, evaluate the best areas to enter the market, use higher time frames to confirm a direction can be useful. I do not recommend using...

Count:1821

Name: Extreme Scalping

Description: This is a test of an easy scalping method: buy if actual close is below forecast close and sell if actual close is above forecast close. Take profit and stop loss shall be very small (few pips) as in most of scalping strategies. No filter is used for only long or only short positions, but you can select buy only or sell only based on other indicators or whatever...

Count:1820

Name: CamarillaStrategy -V1 - H4 and L4 breakout - exits added

Description: Exits added using trailing stops. 2.6 Profit Factor and 76% Profitable on SPY , 5M - I think it's a pretty good number for an automated strategy that uses Pivots. I don't think it's possible to add volume and day open price in relation to pivot levels -- that's what I do manually .. Still trying to add EMA for exits.. it will increase profitability. You can...

Count:1812

Name: PPO Bull/Bear Divergence to High/Low Strategy

Description: A simple strategy that uses the PPO divergences to open trades and the highs/lows to close them. Credit to Pekipek for this PPO Divergence indicator (I changed the visuals a bit) STRATEGY Purple circle - bullish divergence - enter LONG Orange circle - bearish divergence - enter SHORT Green dot - high point - exit LONG Red dot - low point - exit SHORT That's it....

Count:1807

Name: Wolfe Strategy [Trendoscope]

Description: Hello Everyone, Wish you all Merry X-Mas and happy new year. Lets start 2023 with fresh new strategy built on Wolfe Indicator. Details of the indicator can be found here 🎲 Wolfe Concept Wolfe concept is simple. Whenever a wedge is formed, draw a line joining pivot 1 and 4 as shown in the chart below: For simplicity, we will only consider static value for...

Count:1780

Name: 3x SuperTrend Strategy (Mel0nTek) V1

Description: This is a triple SuperTrend based strategy for lower time frame trades such as day trades and scalping. I have not seen many strategies that combine multiple SuperTrends so I thought I would publish this one since I put it together and have been quite happy with the results. I have found through testing that the best results are on currency exchange markets such...

Count:1778

Name: MACD Strategy with trailing ATR stop

Description: This is a trend based strategy that uses EMA and SMA intersection for determining the direction of the trend and MACD for the entry signal. At the same time, the strategy uses ATR, which is working as a trailing stop. The strategy entry will work when the Trend ribbon will turn green and MACD line will crossover the signal line. This strategy also takes into...

Count:1739

Name: Lorentzian Classification Strategy

Description: Based in the model of Machine learning: Lorentzian Classification by @jdehorty, you will be able to get into trending moves and get interesting entries in the market with this strategy. I also put some new features for better backtesting results! Backtesting context: 2022-07-19 to 2023-04-14 of US500 1H by PEPPERSTONE. Commissions: 0.03% for each entry, 0.03%...

Count:1731

Name: Noro's Bands Scalper Strategy v1.6

Description: Noro's Bands for scalping Lime = uptrend Red = downtrend

Count:1726

Name: Ultimate Strategy Template (Advanced Edition)

Description: Hello traders This script is an upgraded version of that one below New features - Upgraded to Pinescript version 5 - Added the exit SL/TP now in real-time - Added text fields for the alerts - easier to send the commands to your trading bots Step 1: Create your connector Adapt your indicator with only 2 lines of code and then connect it to this...

Count:1723

Name: Moving Average Consecutive Up/Down Strategy (by ChartArt)

Description: This simple strategy goes long (or short) if there are several consecutive increasing (or decreasing) moving average values in a row in the same direction. The bars can be colored using the raw moving average trend. And the background can be colored using the consecutive moving average trend setting. In addition a experimental line of the moving average change can...

Count:1701

Name: Fancy Bollinger Bands Strategy [BigBitsIO]

Description: This script is for a Bollinger Band type indicator with built-in TradingView strategy including as many features as I can possibly fit into a Bollinger Band type indicator including a wide variety of options to create the most flexible Bollinger Bands strategy possible. Features: - A single custom moving average serving as the middle band. - Standard MA...

Count:1676

Name: Supply Demand Profiles [LuxAlgo]

Description: The Supply Demand Profiles is a charting tool that measures the traded volume at all price levels on the market over a specified time period and highlights the relationship between the price of a given asset and the willingness of traders to either buy or sell it, in other words, highlights key concepts as significant supply & demand zones, the distribution of...

Count:1669

Name: Scalping with Bill Williams Alligator

Description: Scalping strategy based on Bill Williams Alligator technique but calculated with heikin ashi candles. This strategy has to be applied to standard candles and low time frames (1min to 5min) Thanks to all pinescripters mentined in the code for their snippets. It could be improved with stop loss based on ATR etc. I have also a study with alerts. Please use...

Count:1656

Name: Keltner bounce from border. No repaint. V2 (by Zelibobla)

Description: WARNING: despite of strategy doesn't use future data (not repaints) it doesn't consider broker`s commissions, which can be harmful for real life high frequency trading. Strategy will definitely fail on non-ordinary security behavior. But if new behavior will get stable, tuned params should make strategy profitable again. This is the second version of this...

Count:1652

Name: Swing Hull/rsi/EMA Strategy

Description: A Swing trading strategy that use a combination of indicators, Hull average to get the trend direction, ema and rsi do the rest, use it are your own risk expecially at the end of any hull trend Past Performance Does Not Guarantee Future Results

Count:1651

Name: Range Detector [LuxAlgo]

Description: The Range Detector indicator aims to detect and highlight intervals where prices are ranging. The extremities of the ranges are highlighted in real-time, with breakouts being indicated by the color changes of the extremities. 🔶 USAGE Ranging prices are defined by a period of stationarity, that is where prices move within a specific range. Detecting...

Count:1634

Name: HHLL Strategy

Description: This is simple Highest high and Lowest low strategy. Buy when break HH+offset Sell when break LL+offset Offset = (HH-LL)/2

Count:1621

Name: Super Guppy Strategy

Description: CM Super Guppy with Long/Short signals, backtesting, and additional options. Updated for PineScript v4. COINBASE:BTCUSD Features 2 primary modes, depending on your risk profile. These options are available in the settings: "Early Signals" ON (default): Prints a "long" on grey to green transitions AND red to gray transitions. Prints a "short" on...

Count:1615

Name: [Daveatt] BEST ABCD Pattern Strategy (Trailing SL + TP)

Description: Hello traders This is the strategy version of my ABCD pattern. I added the Trailing Stop and Trailing Profit upon a follower request I - Concept I present to you, ladies and gentlemen, the first screener for harmonic patterns . Starting with an ACBD pattern screener this time!! I used the calculations from Ricardo Santo's script In short, he's using...

Count:1596

Name: K.M Trend Strategy (BETA 1.2)

Description: My beautiful traders, how is everyone doing? This indicator I built detects trends, I haven't seen any repaints, I only had 3 minor ones. It is still on BETA version. To all new traders, and busy traders I will be posting one that you can set alerts. Please look under my profile or type " K.M Trend Alerts (BETA 1.2) " . I ask for everyone to try this script...

Count:1585

Name: ATR Strategy Back test

Description: Original script by HPotter ATR strategy is profitable. Buy when it says buy and sell when it says sell.

Count:1567

Name: EMA Slope Cross Trend Follower Strategy

Description: This strategy uses the cross of the slopes of two EMAs having different lengths to generate trend follower signals. By default, I use 130 and 400, which behave very well. The conditions which make the strat enter the market are: - Fast Slope > Slow Slope and price > EMA 200 : go Long - Fast Slope < Slow Slope and price < EMA200 : go Short The simple slopes cross...

Count:1565

Name: VXD Cloud Edition

Description: VXD Cloud Edition. to overcome sideways market conditions this cloud configured for low timeframe. every TA is same as VXD Supercycle but show as cloud. Symbols on chart show Premium and Discount Prices X-Cross = Engulfing Candle with weak volume . O-circle - Engulfing Candle with strong volume . Pivot point and Rejected Block Pivot show...

Count:1562

Name: Easy to Use MACD+RSI Strategy

Description: BEGINNERS REJOICE! Easy to use strategy test using MACD with RSI as a confirming indicator. The code is structured to make it easy to manipulate the variables to your choosing. EASY TO CHANGE CODE VARIABLES LINE 2 = Change the amount you invest every trade and the currency LINE 8/9/10 = Change the defval of each of these lines to backtest from a...

Count:1562

Name: TSI CCI Hull with profit$$$

Description: This is a modified version of @SeaSide420 TSI CCI Hull with profits exit on long and short order ORIGINAL SCRIPT: /// /// feel free to edit/improve and comment

Count:1559

Name: EDMA Scalping Strategy (Exponentially Deviating Moving Average)

Description: This strategy uses crossover of Exponentially Deviating Moving Average (MZ EDMA ) along with Exponential Moving Average for trades entry/exits. Exponentially Deviating Moving Average (MZ EDMA ) is derived from Exponential Moving Average to predict better exit in top reversal case. EDMA Philosophy EDMA is calculated in following steps: In first step,...

Count:1556

Name: Trendline Breakouts With Targets [ChartPrime]

Description: The Trendline Breakouts With Targets indicator is meticulously crafted to improve trading decision-making by pinpointing trendline breakouts and breakdowns through pivot point analysis. Here's a comprehensive look at its primary functionalities: Upon the occurrence of a breakout or breakdown, a signal is meticulously assessed against a false signal...

Count:1549

Name: Keltner Channel - Trend Based Strategy

Description: This strategy is based on 3 main indicators. 1st indicator is a trend indicator, which consists of SMA and EMA 2nd is Keltner Channel 3rd is DM indicator. The conditions for the entry of this strategy are following: First of all the assets need to be in an upward trend, this will occur when the EMA will cross SMA. The next condition for the entry is the...

Count:1539

Name: yuthavithi volatility based force trade scalper strategy

Description: I have converted my volatility based force scalper into strategy. Nice to see it is so profitable. Work best with Heikin Ashi bar.

Count:1538

Name: Renko Strategy Open_Close

Description: Simple Renko strategy, very profitable. Thanks to vacalo69 for the idea. Rules when the strategy opens order at market as follows: - Buy when previous brick (-1) was bearish and previous brick (-2) was bearish too and actual brick close is bullish - Sell when previous brick (-1) was bullish and previous brick (-2) was bullish too and actual brick close is...

Count:1526

Name: Band-Zigzag - TrendFollower Strategy [Trendoscope]

Description: Strategy Time!!! Have built this on my earlier published indicator Band-Zigzag-Trend-Follower . This is just one possible implementation of strategy on Band-Based-Zigzag . 🎲 Notes Experimental prototype. Not financial advise and strategy not guaranteed to make money despite backtest results Not created or tested for any specific instrument or...

Count:1516

Name: RSI Binary Strategy

Description: Another basic strategy most people learn at the beginning of their trading carreer (like me) is the RSI strategy. This is an adaptation of the built-in RSI strategy for use in binary options. Who knows, maybe one day i will graduate to CFD trading, but my time for trading in general is limited at the moment and I am very much still at the beginning of this entire...

Count:1514

Name: Instrument-Z (3Commas Bot)

Description: Instrument-Z is what I am currently using as my 3Commas Bot. It allows you to customize signals from 3 indicators; Crossing MA's, Stochastic RSI, and WaveTrend. Better yet, it allows you to setup these signals separately depending on whether the Trend MA is going up or down. So there are 2 sets of inputs for everything, Uptrend inputs and Downtrend inputs. I have...

Count:1509

Name: BB+AO STRAT

Description: to be used with AO indicator, based on forex strat -- www.forexstrategiesresources.com works on 1/3/5/15/30 candles, buy signals are best when the black 3 fast ema crosses up through the red mid band

Count:1503

Name: SuperTREX strategy

Description: This is the strategy of Super Trex that i put as open source before i just add option for non security MTF and take profit steps as i shown before for different coins or assets you need to set different parameters

Count:1486

Name: Ichimoku Kinko Hyo Cloud - no offset - no repaint - strategy

Description: Ichimoku Kinko Hyo Cloud - no offset - no repaint - RSI filter - strategy The indicator contains both the standard Ichimoku Cloud , as well as the one without the visual offset. The Strategy Tester indicates good backtest results when the Ichimoku Cloud is paired with the RSI . However, it seems it likes to work more as a standalone system. The indicator can...

Count:1482

Name: Hulk Strategy x35 Leverage 5m chart w/Alerts

Description: This strategy is a pullback strategy that utilizes 2 EMAs as a way of identifying trend, MACD as an entry signal, and RSI and ADX to filter bad trades. By using the confirmation of all of these indicators the strategy attempts to catch pullbacks, and it is optimized to wait for high probability setups. Take not that the strategy is optimized for use on...

Count:1478

Name: Real Turtle

Description: There are a few different attempts at the turtle strategy on here, but none that I have seen thus far correctly follow the strategy as I know it. This version uses a stop order to trail out of the position by moving the stop order to match the exit channel or stoploss as the N*2( ema of True Range * 2). This version of turtle strategy also uses stop orders for...

Count:1477

Name: MACD + Stochastic + RSI Strategy

Description: My strategy uses a combination of three indicators MACD Stochastic RSI. The Idea is to buy when (MACD > Signal and RSI > 50 and Stochastic > 50) occures at the same time This strategy works well on stocks and cryptos especially during market breaking up after consolidation The best results are on Daily charts, so its NOT a scalping strategy. But it can work...

Count:1463

Name: 5min MACD scalp by Joel

Description: This strategy is inspired by a youtuber called Joel on Crypto. He trades this using Ema, MACD indicators and his own experience. For more information, check out his Best Crypto Scalping Strategy for the 5 Min Time Frame video. I have tried to automate this a little. Long or Short trades are determined with a crossing of the fast Ema over the slow Ema for Long and...

Count:1459

Name: DCA Bot Emulator

Description: Emulate DCA bot. Buy ASAP. Set chart interval to 1 hour.

Count:1410

Name: Template Trailing Strategy

Description: This script is meant to be used as a generic template for new strategies. Take Profit, Stop Loss logic is provided out of the box with (or without) their trailing variations while the trailing for entry and exit orders can also be enabled and be configured! Custom quantity risk management is provided along with the ability to set custom signal messages that can be...

Count:1405

Name: Custom Screener with Alerts [QuantNomad]

Description: Some time ago I published an example of simple custom screener in PineScript: The only thing this screener did is created a dynamic label with screener output. Recently TradingView announced alerts from the strategy with the possibility to add custom messages to alerts. So using it I was able to create a bit more advanced screener which sends results as...

Count:1405

Name: V Bottom & V Top Pattern [Misu]

Description: █ This indicator shows V bottom & V top patterns as well as potential V bottom & V top. These V bottom & V top are chart powerful reversal patterns. They appear in all markets and time-frames, but due to the nature of the aggressive moves that take place when a market reverses direction, it can be difficult to identify this pattern in real-time. To address this...

Count:1404

Name: Built-in Kelly ratio for dynamic position sizing

Description: This is the defaut keltners channel strategy with a few additions. The main purpose is to show how we include the Kelly ratio into our scripts for dynamic position sizing based on the performance of the strategy on a per trade basis. We've also included the usual take-profit and stop-loss parameters in the event you want to play a little :) We hope this helps...

Count:1401

Name: How to automate this strategy for free... Version 2

Description: Hello fellow traders and automation lovers. It has been about 2 years since we originally created Autoview to connect your exchanges/brokers with your TradingView alerts. We've since added multiple exchanges, parameters and have built a large community filled with awesome, passionate traders. One of the first strategies we built was sadly not a viable one for...

Count:1400

Name: CRYPTO 3EMA Strategy with Take Profit & Stop Loss based on ATR

Description: Simple 3 EMA Strategy with plotted Take Profit and Stop Loss Entry condition: - Middle EMA cross above the Slow EMA - Set take profit and stop loss exit conditions based on ATR Indicator Exit condition: - Fast EMA cross below the Middle EMA

Count:1392

Name: EMA Cross Strategy

Description: This double EMA crossover strategy aims to illustrate a good strategy design. It is currently the only published script that: supports a proper date picker for the backtest period is able to test in short and long mode only

Count:1391

Name: UT Bot v5

Description: This is an update by request, on someone elses strategy! well more of an edit, but also update from pine v4 to pine v5. //CREDITS to HPotter for the orginal code. The guy trying to sell this as his own is a scammer lol. //Edited and converted to @version=5 by SeaSide420 for Paperina The UT Bot v5 is Movinging average (the MA) vs ATR (the ATR is in the form...

Count:1388

Name: MACD 5 iN 1 [Pro-Tool]

Description: introducing MACD Which has different indicators inside, And not only that, five different strategies have also been included in this indicator. Strategy №1:👉 MACD Crossover Signal Line Strategy №2:👉 MACD Crossover + MACD Overbought Section (for ignore false Crossover signals) Strategy №3:👉 MACD Crossover + Market Close should b greater tha MOVING AVERAGE Strategy...

Count:1388

Name: ATR Trailing Stop Strategy by ceyhun

Description: Same coding only coloring and strategy version added //Barcolor Green = Trail1 > Trail2 and close > Trail2 and low > Trail2 Blue = Trail1 > Trail2 and close > Trail2 and low < Trail2 Red = Trail2 > Trail1 and close < Trail2 and high < Trail2 Yellow = Trail2 > Trail1 and close < Trail2 and high > Trail2 //It gives White color where there is...

Count:1378

Name: MACD + BB + RSI Strategy [Alorse]

Description: A very simple and highly effective strategy that combines 3 famous indicators: MACD Bollinger Bands RSI Entry conditions are: The MACD line crosses over the signal line. RSI less than 50 Price below the BB baseline Exit conditions are: RSI greater than 70 Closing price higher than the upper BB Or when the price hits the Stop Loss...

Count:1372

Name: VWAP Trendfollow Strategy [wbburgin]

Description: This is an experimental strategy that enters long when the instrument crosses over the upper standard deviation band of a VWAP and enters short when the instrument crosses below the bottom standard deviation band of the VWAP. I have added a trend filter as well, which stops entries that are opposite to the current trend of the VWAP. The trend filter will reduce...

Count:1370

Name: Backtesting on Non-Standard Charts: Caution! - PineCoders FAQ

Description: Much confusion exists in the TradingView community about backtesting on non-standard charts. This script tries to shed some light on the subject in the hope that traders make better use of those chart types. Non-standard charts are: Heikin Ashi (HA) Renko Kagi Point & Figure Range These chart types are called non-standard because they all transform market...

Count:1365

Name: BEST Trailing Take Profit Strategy

Description: Hello traders Hope you enjoyed your weekend on my behalf. Was staying home working ... ^^ This is my first strategy educational post I'm doing ever While I'm generally against posting strategies because it's very easy to fake performance numbers... I cannot prevent myself from sharing a few cool strategy snippets anyway. So from now on, I'll be sharing a few...

Count:1363

Name: PMax on Rsi w/T3 *Strategy*

Description: Profit Maximizer Indicator on RSI with Tillson T3 Moving Average: PMax uses ATR calculation inside, for this reason users couldn't manage to use PMax on RSI because RSI indicator doesn't have High and Low values in bars, but ATR needs that values. So I personally calculate RSI in a different way to have High and Low values of RSI wrt price...

Count:1339

Name: [DS]Entry_Exit_TRADE.V01-Strategy

Description: The proposal of this script is to show the possible trading points of BUY and SELL based on the 15-minute chart of the Nasdaq Future Index. The start point of the strategy was schedule for 2021/01/01 and until the time of this publication (2021/01/31), for 1 index contract the results presented area a Gross Profit of 2.97% with a Net Profit of 1.35%. █ FEATURES...

Count:1338

Name: Maximized Scalping On Trend (by Coinrule)

Description: " The trend is your friend. " This is one of the most famous and valuable teachings that experienced traders can give to newbies. There is a reason for that. No matter your views about where the price moves, what matters is where the price heads to . The market is always right, and ultimately it decides who gets the profit and who has to take a loss. The...

Count:1325

Name: Powertrend - Volume Range Filter Strategy [wbburgin]

Description: The Powertrend is a range filter that is based off of volume, instead of price. This helps the range filter capture trends more accurately than a price-based range filter, because the range filter will update itself from changes in volume instead of changes in price. In certain scenarios this means that the Powertrend will be more profitable than a normal range...

Count:1323

Name: Trailing Take Profit Trailing Stop Loss

Description: This script demonstrated a dual trailing take profit and stop loss strategy. Where you take 50% (configurable) of the profit when a price level is reached and then you get the rest when a trailing stop loss is hit.

Count:1321

Name: Simple Moving Average Strategy

Description: This is a modification of MOVINGAVG CROSS with different inputs of bar lengths that work with a great average percentage with not much drawdown. I ran the strategy tester with GBPUSD on 1 hour time frame.

Count:1318

Name: 3C QFL Mean reversal

Description: What is QFL trading strategy? QFL stands for Quickfingersluc, and sometimes it is referred to as the Base Strategy or Mean Reversals. Its main idea is about identifying the moment of panic selling and buying below the base level and utilizing Safety orders. What is Base level or Support Level? Base level or Support Level refers to the lowest price level that...

Count:1316

Name: Y-Profit Maximizer Strategy with Exit Points

Description: This script based on KivancOzbilgic 's PMax indicator. I modified a bit. Added Filters, Exit (TP) Levels and few indicator in it. This script opening only Long Positions. I have used this indicators in this strategy: -Moving Stop Loss (Most) by ceyhun -PMax Explorer STRATEGY & SCREENER -Bollinger Bands on Macd -Tillson T3 Moving Average by KIVANÇ fr3762 I am...

Count:1309

Name: MA Bollinger Bands + RSI

Description: This script uses the standard deviation of a given moving average along with an RSI direction. When: rsi crossover neutral line + price crossover lower deviation boundary => long When: rsi crossunder neutral line + price crossunder upper deviation boundary => short

Count:1307

Name: Sweat Dreams - Extra high profitable

Description: Available for all time frames Available for all crypto currency pairs High-profitable on all time frames The script is the dream of all traders Repaints like a boss. Use at your own risk, or don't use at all!

Count:1301

Name: ATR Parabolic SAR Strategy [QuantNomad]

Description: I created a version of Parabolic SAR when I accelerate it not based on the difference from the extreme point but based on current ATR. So the idea is that for a more volatile market it should move faster. Performance is calculated based on 25% equity invested and 0.1% commission. What do you think about it? Does it make sense to do something like that? Do you...

Count:1299

Name: Heikin Ashi Supertrend

Description: About this Strategy This supertrend strategy uses the Heikin Ashi candles to generate the supertrend but enters and exits trades using normal candle close prices. If you use the standard built in Supertrend indicator on Heikin Ashi candles, it will produce very unrealistic backtesting results because it uses the Heikin Ashi prices instead of the real prices....

Count:1294

Name: Cumulative RSI Strategy

Description: I suppose nothing drives a point home like a 10+ year backtest! A couple of weeks ago I published a custom indicator called the Cumulative RSI. This indicator was straight out of chapter 9 of "Short Term Trading Strategies That Work." Today I am publishing a basic sample strategy in that uses the Cumulative RSI as its only entry and exit signals on a Nasdaq 100...

Count:1293

Name: Sequential Up/Down

Description: This strategy is based on TD sequential study from glaz. I made some improvement and modification to comply with pine script version 4. Basically, it is a strategy based on proce action, supports and resistance and can be used also for scalping. It could be improved with exit rules, stop loss based on ATR etc. I have also a study with alerts. Please use...

Count:1289

Name: MULTIPLE TIME-FRAME STRATEGY(TREND, MOMENTUM, ENTRY)

Description: Hey everyone, this is one strategy that I have found profitable over time. It is a multiple time frame strategy that utilizes 3 time-frames. Highest time-frame is the trend, medium time-frame is the momentum and short time-frame is the entry point. Long Term: - If closed candle is above entry then we are looking for longs, otherwise we are looking for shorts ...

Count:1288

Name: SuPeR-RePaNoCHa #2TP#

Description: This is the last of the 'RePaNoCHa' script for Automatic Trading ;-) ... This time with two take profits ... It Use 6 indicators + volume: -JURIK MOVING AVERAGE -RANGE FILTER -ADX -PARABOLIC SAR -RSI + VOLUME WEIGHTED -MACD -VOLUME To close the position you can choose between 2 Take Profit and the amount to use on each one. You can transform it yourself into...

Count:1287

Name: Parabolic SAR Strategy (on close) [QuantNomad]

Description: Created a Parabolic SAR strategy where price has to close under/above the level before for it to reverse. This way it should be a bit more stable and protect you from false breakouts. It was impossible to adjust the built-in "sar" function so I implemented PSAR from scratch. So if you're interested in how it's work inside you can check the code and probably...

Count:1286

Name: [STRATEGY][UL]QQE Cross v1.1

Description: Updated by request: this is a "Strategy" trading version of the "QQE Cross Indicator Alert v2.0 by JustUncleL" (which is mainly for Binary Options trading), the same BUY/SELL signals are used to generate trade entry and exit conditions. Thanks again to JayRogers for making the Strategy risk management easier to understand and implement. In this update I have...

Count:1279

Name: Zendog V2 backtest DCA bot 3commas

Description: Hi everyone, After a few iterations and additional implemented features this version of the Backtester is now open source. The Strategy is a Backtester for 3commas DCA bots. The main usage scenario is to plugin your external indicator, and backtest it using different DCA settings. Before using this script please make sure you read these explanations and make sure...

Count:1275

Name: Narrow Range + Inside Day, Long Only Strategy (by ChartArt)

Description: This long only strategy determines when there is both a NR7 (narrow range 7, a trading day in which the range is narrower than any of the previous six days), plus a inside day (high of the current day is lower than the high of the previous day and the low of the current day is higher than the low of the previous day) both on the same trading day and enters a long...

Count:1270

Name: Strategy Follow Line Indicator

Description: The objective is only to evaluate different configurations, I do not recommend using only this indicator to trade, because you can lose all your money if you do not know what you are doing. I hope you find it useful. Successes

Count:1257

Name: Trend Trader Strategy with MACD

Description: This is plots the indicator developed by Andrew Abraham in the Trading the Trend article of TASC September 1998 The strategy I use has already been published explicitly by HPotter, you can review the core code from there. I have converted the existing strategy codes that have been published into the strategy and the result looks great but I noticed that the...

Count:1256

Name: RSI on VWAP Upgraded strategy

Description: First of all, the idea of apply RSI to VWAP was inspired by XaviZ; at least, that where I first saw that. I simply applied the idea and searched for apply this on lower timeframe (M15) to increase the number of positions and improve the profit factor. The conditions to enter are the same : long : enter on RSI crossover oversold level short : enter on RSI...

Count:1251

Name: BEST Supertrend Strategy

Description: Hello traders Sharing a sample Supertrend strategy to illustrate how to calculate a convergence and using it in a strategy I based the setup as follow: - Entries on Supertrend MTF breakout + moving average cross. Entering whenever there is a convergence - exit whenever a Simple Moving Averages cross in the opposite direction happen - possibility to filter only...

Count:1249

Name: [Autoview][BackTest]Dual MA Ribbons R0.12 by JustUncleL

Description: This is an implementation of a strategy based on two MA Ribbons, a Fast Ribbon and a Slow Ribbon. This strategy can be used on Normal candlestick charts or Renko charts (if you are familiar with them). The strategy revolves around a pair of scripts: One to generate alerts signals for Autoview and one for Backtesting, to tune your settings. The risk management...

Count:1245